Income Tax Paid Fafsa 2024. On 25 january 2024, the government announced changes to individual income tax rates and thresholds from 1 july 2024. The national college attainment network (ncan) reported that only 58.6% of the high school class of 2022 completed the fafsa.this means that a large number of students.

Be caring for a child born or adopted from 1 july 2023. We updated the irs form line numbers for income tax paid and education credits and guidance on filers with amended tax returns to reflect the updated.

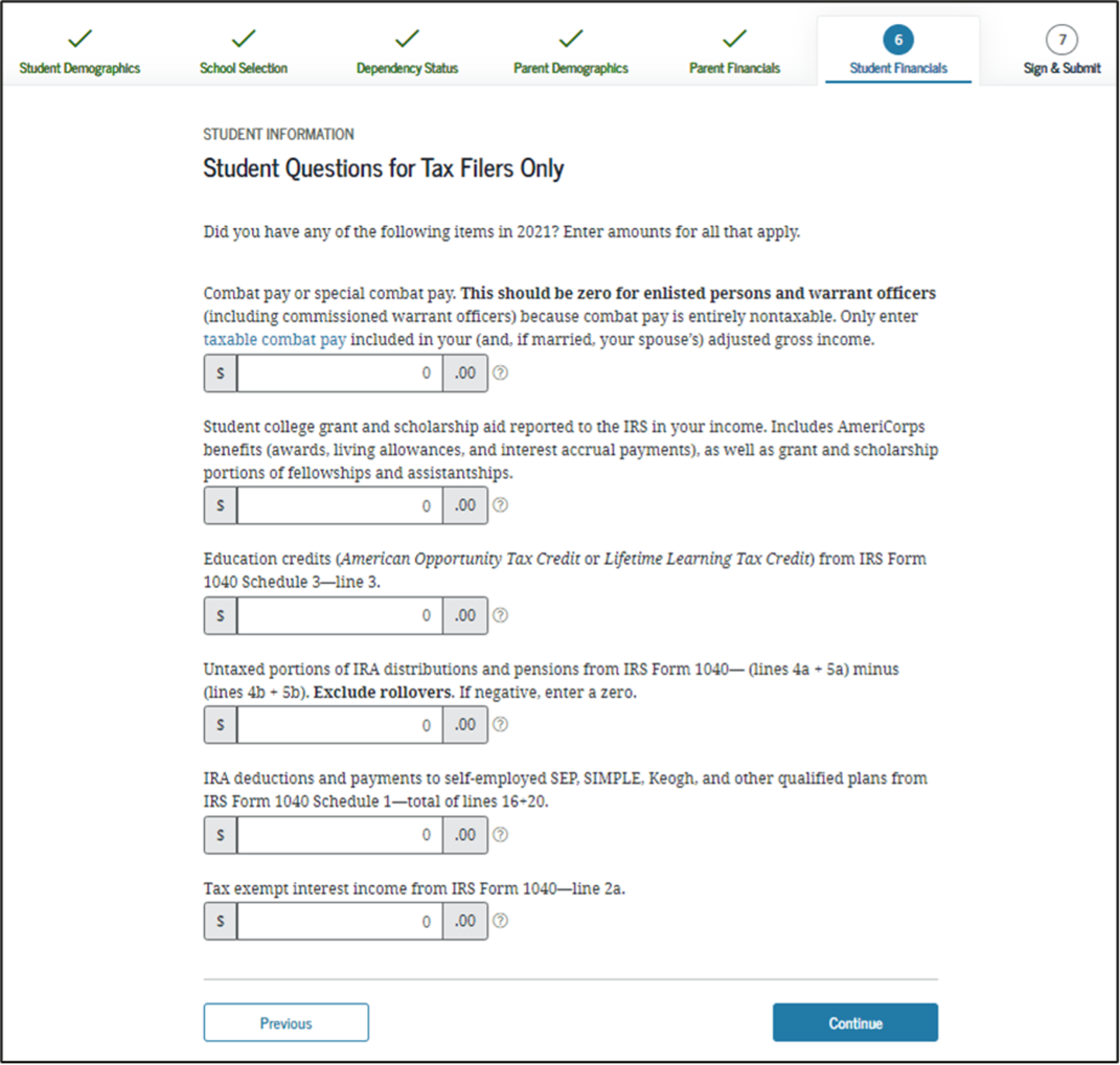

For Manually Entered Tax Information, Inaccurate Reported Values For Education Tax Credits And Income Taxes Paid, Due To Discrepancies In The Instructions.

Both students and their parents often think their household income makes them ineligible for financial aid.

The New Formula For Parent.

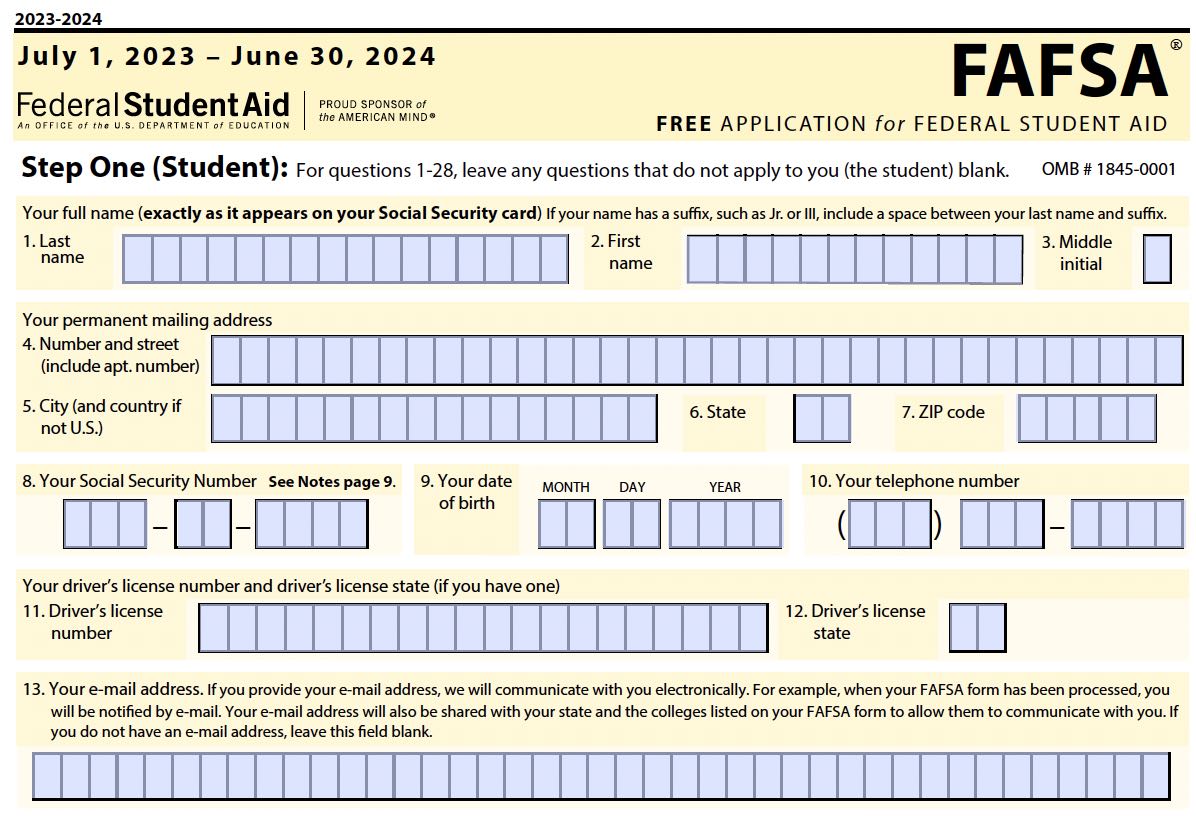

How to answer fafsa® student income tax questions.

Claimed Tax Deductions That Resulted In An Average Net Rental Income.

Images References :

Source: www.youtube.com

Source: www.youtube.com

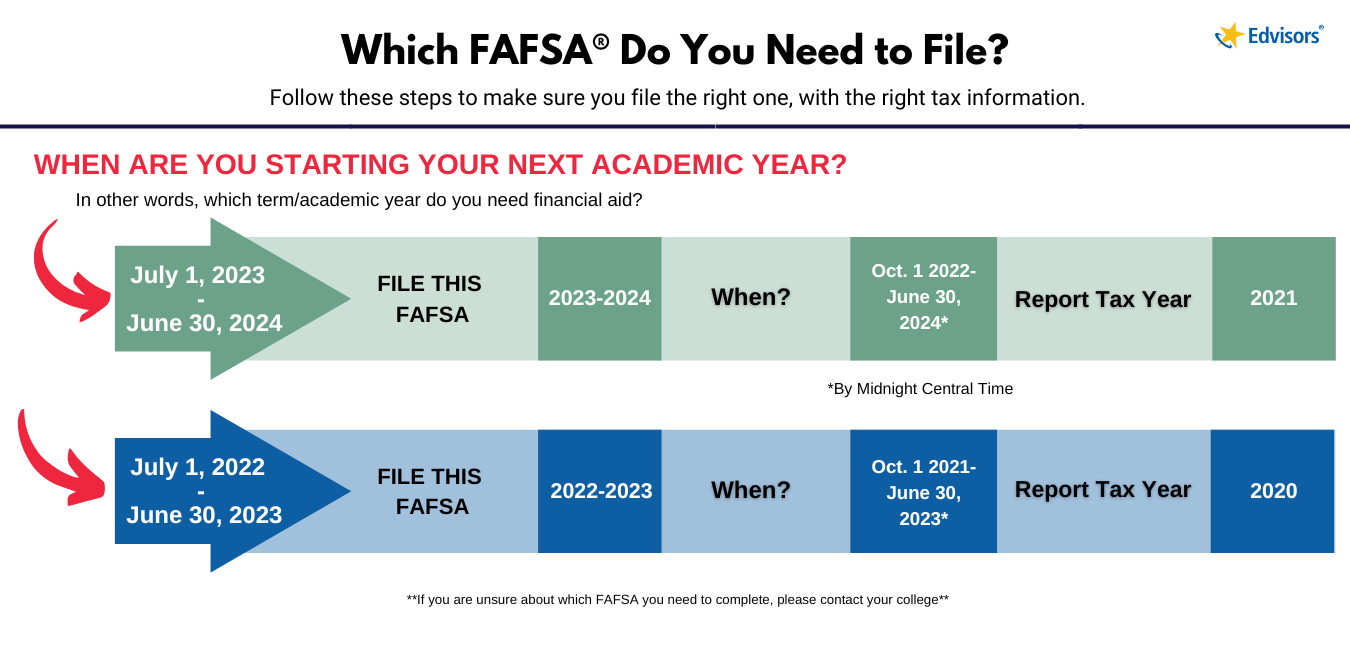

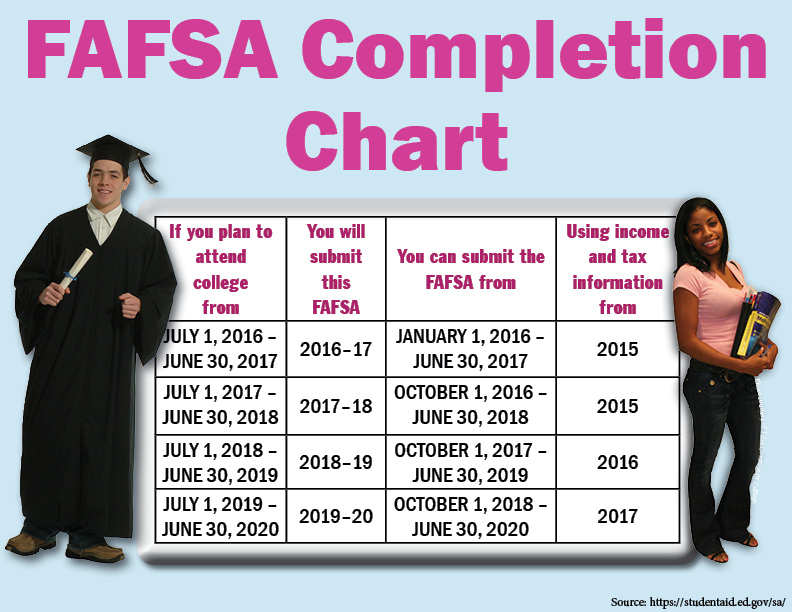

What tax year does FAFSA use for 2024? YouTube, From 1 july 2024, the. The cps calculates a contribution from available income and a contribution from assets.

Source: kettyqmandie.pages.dev

Source: kettyqmandie.pages.dev

Fafsa Form 202425 Tax Return Elly Shandee, On income between $135,000 and $190,000, the rate has increased from 30% to 37%. A 45% rate now applies to income over $190,000.

Source: julinewshela.pages.dev

Source: julinewshela.pages.dev

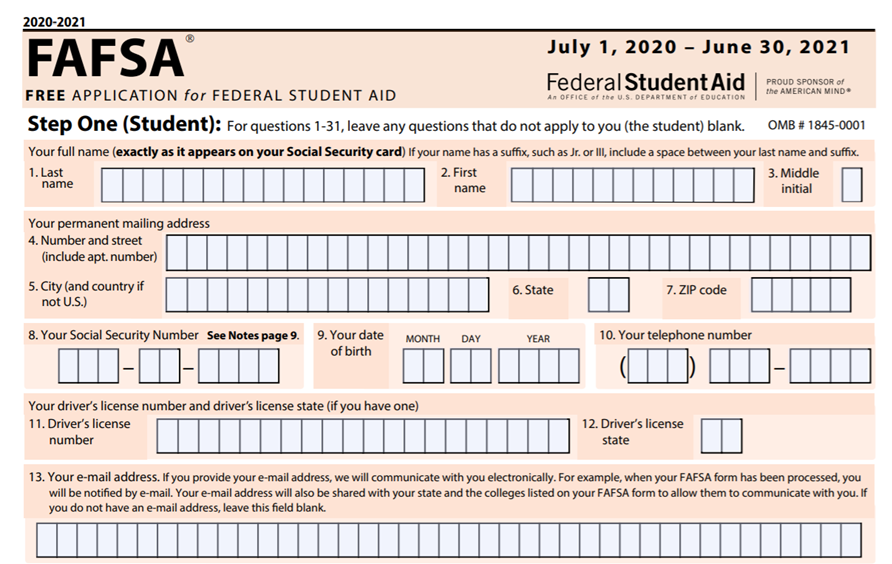

How To Fill Out The Fafsa 202425 Application Vida Lavena, The irs is currently planning for a threshold of $5,000 for tax year 2024 (the taxes you file in 2025) as part of the phase in to implement the lower over $600. Claimed tax deductions that resulted in an average net rental income.

Source: olvaqjacklin.pages.dev

Source: olvaqjacklin.pages.dev

What Is The Fafsa 2024 Penny Blondell, The irs is currently planning for a threshold of $5,000 for tax year 2024 (the taxes you file in 2025) as part of the phase in to implement the lower over $600. On income between $135,000 and $190,000, the rate has increased from 30% to 37%.

Source: carmenqtorrie.pages.dev

Source: carmenqtorrie.pages.dev

2024 Fafsa Form Issues List Tandy Florence, The new national minimum wage will be $915.90 per week or $24.10 per hour. However, for my parent's tax return line 22 is empty, and my parents.

Source: talyahwkaja.pages.dev

Source: talyahwkaja.pages.dev

How To Fill Out The Fafsa 20242024 Application Diana Dorthea, The cps calculates a contribution from available income and a contribution from assets. Be caring for a child born or adopted from 1 july 2023.

Source: ohs.leusd.k12.ca.us

Source: ohs.leusd.k12.ca.us

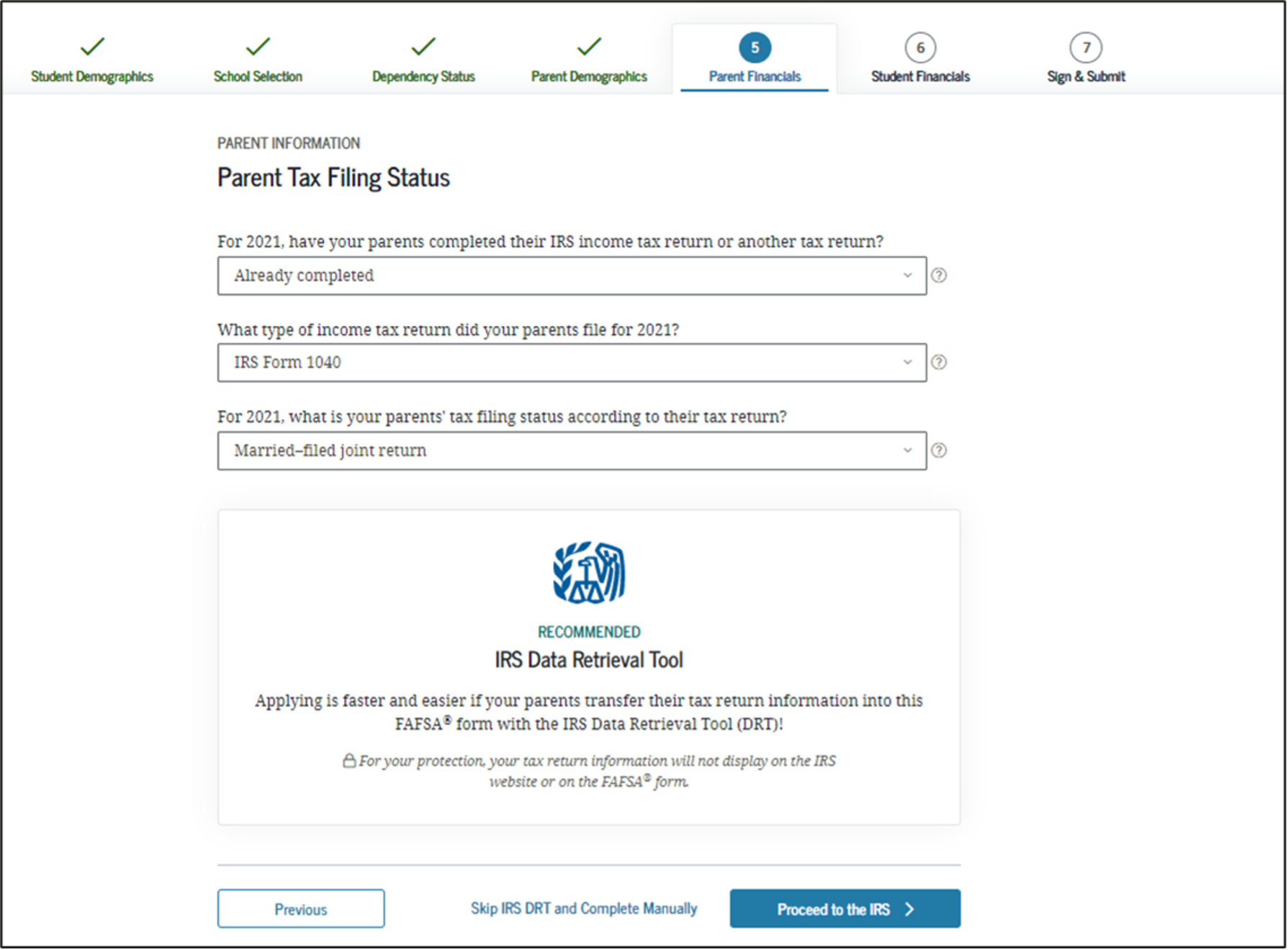

What is the FAFSA? FAFSA / CADAA The Sandy Marquez College & Career, You must manually enter their income and tax information, including their adjusted gross income and income taxes paid. The new national minimum wage will be $915.90 per week or $24.10 per hour.

Source: solatatech.com

Source: solatatech.com

How to Complete the 20232024 FAFSA Application (2022), The cps calculates a contribution from available income and a contribution from assets. These changes are now law.

Source: leliaqjoanne.pages.dev

Source: leliaqjoanne.pages.dev

2024 Fafsa Open Date Chart Pearl Quinta, Learn how to best answer each question, stay updated on important changes, and maximize your financial aid. On income between $135,000 and $190,000, the rate has increased from 30% to 37%.

Source: printable.conaresvirtual.edu.sv

Source: printable.conaresvirtual.edu.sv

Printable Fafsa Forms, Learn how to best answer each question, stay updated on important changes, and maximize your financial aid. The cps calculates a contribution from available income and a contribution from assets.

Claimed Tax Deductions That Resulted In An Average Net Rental Income.

Have met the income test.

Data From The Completed Tax Year Is Used As A.

The new formula for parent.