Montana State Taxes 2024. Calculate your annual salary after tax using the online montana tax calculator, updated with the 2024 income tax rates in montana. Customize using your filing status, deductions, exemptions and more.

The 2024 tax rates and thresholds for both the montana state tax tables and federal tax tables are comprehensively integrated into the montana tax calculator for 2024. The montana state tax calculator (mts tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

Montana's 2024 Income Tax Ranges From 1% To 6.75%.

Among several changes to montana’s income tax system that took effect at the beginning of 2024 is a provision that makes income from tips subject to state income.

Major Changes Are Coming To Montana’s Income Tax System Beginning In Tax Year 2024, Including Changes To Filing Statuses, Tax Brackets, And The Calculation Of Montana Taxable Income.

The montana state tax calculator (mts tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

Montana Entered 2024 With A Flurry Of New Laws Going Into Effect, Impacting The State In Various Ways Including When It Comes To Taxes, Internet Age Verification For.

Images References :

Source: taxedright.com

Source: taxedright.com

Montana State Taxes Taxed Right, On may 18, 2023, montana governor greg gianforte. The law consolidated the state’s seven tax brackets for individual income into two and reduced the top marginal rate from 6.75 percent to 6.5 percent.

Source: montanabudget.org

Source: montanabudget.org

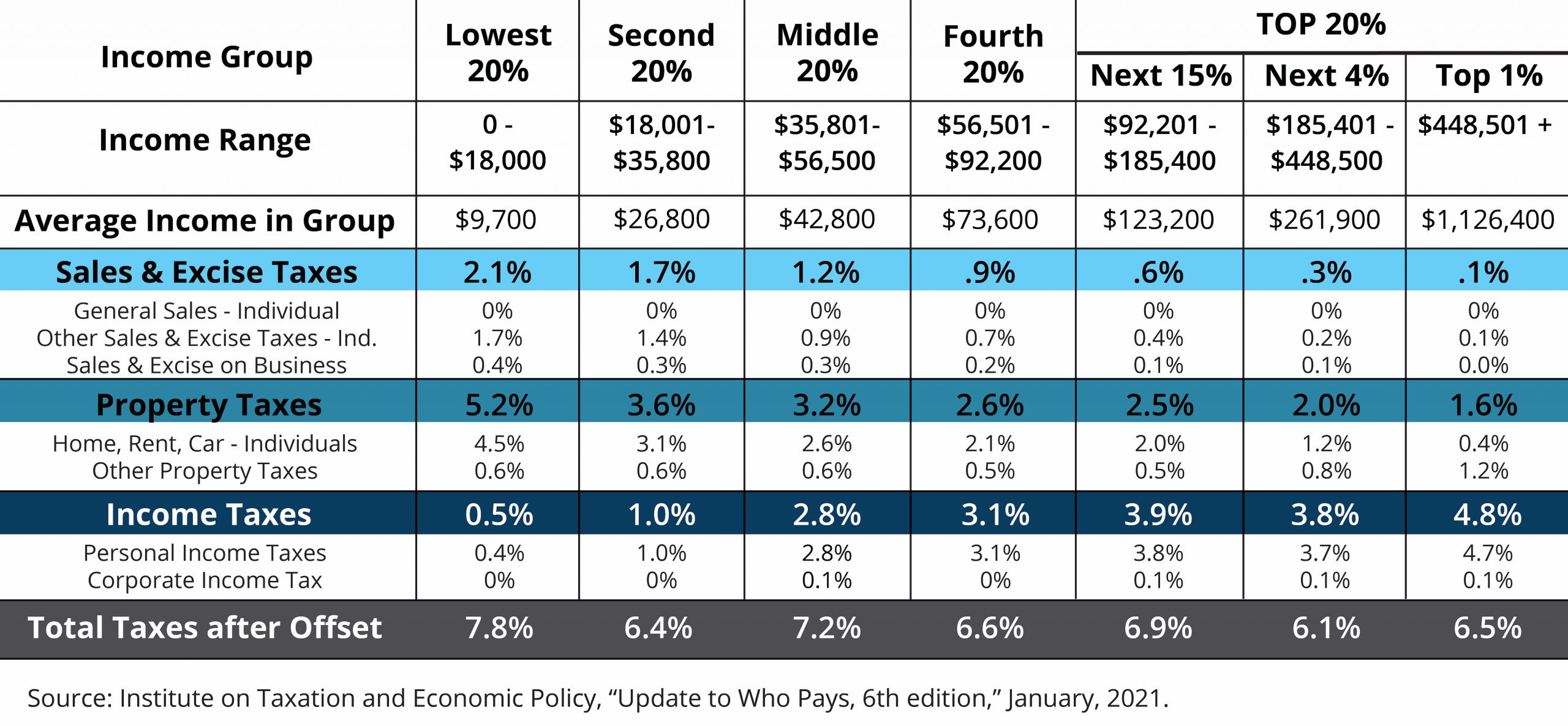

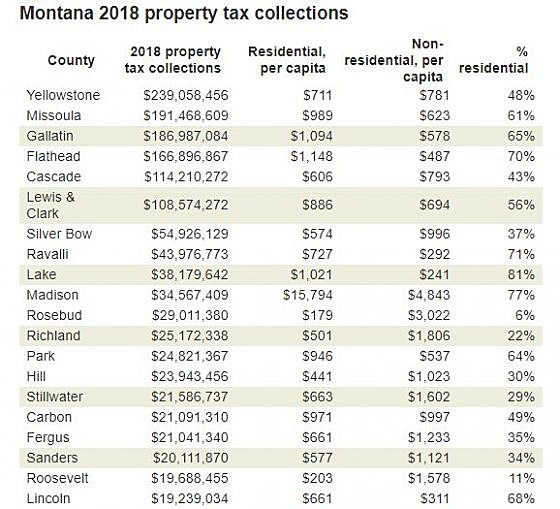

Policy Basics Who Pays Taxes in Montana Montana Budget & Policy Center, Customize using your filing status, deductions, exemptions and more. Major changes are coming to montana’s income tax system beginning in tax year 2024, including changes to filing statuses, tax brackets, and the calculation of montana taxable income.

Source: coinappraiser.com

Source: coinappraiser.com

2007 Montana State Quarter Sell Silver State Quarters, The 2024 tax rates and thresholds for both the montana state tax tables and federal tax tables are comprehensively integrated into the montana tax calculator for 2024. Montana's 2024 income tax ranges from 1% to 6.75%.

Source: logowik.com

Source: logowik.com

Montana State Billings Yellowjackets Logo PNG vector in SVG, PDF, AI, Calculate your annual salary after tax using the online montana tax calculator, updated with the 2024 income tax rates in montana. Among several changes to montana’s income tax system that took effect at the beginning of 2024 is a provision that makes income from tips subject to state income.

Source: www.taunyafagan.com

Source: www.taunyafagan.com

Montana State Taxes Tax Types in Montana Property, Corporate, Customize using your filing status, deductions, exemptions and more. Major changes are coming to montana’s income tax system beginning in tax year 2024, including changes to filing statuses, tax brackets, and the calculation of montana taxable income.

Source: missoulacurrent.com

Source: missoulacurrent.com

Montana property taxes keep rising, but Missoula isn't at the top, This page has the latest montana brackets and tax rates, plus a montana income tax calculator. Those rates were enacted in 2021 (effective in 2024), scheduling a reduction of the current seven income brackets into two.

Source: wildmontanaaction.org

Source: wildmontanaaction.org

What the 2022 Montana Election Means for Public Lands Wild Montana, 121, enacted in march 2023, simplified the individual income tax system in montana and, effective january 1, 2024, reduced the number of tax. Calculate your total montana state income tax state taxable income gross income adjusted − (state standard/itemized deductions + state exemptions) = state.

Source: pboadvisory.com

Source: pboadvisory.com

2023 Tax Bracket Changes PBO Advisory Group, Montana state tax rates and rules for income, sales, property, fuel, cigarette, and other taxes that impact residents. Customize using your filing status, deductions, exemptions and more.

Source: www.marca.com

Source: www.marca.com

Tax payment Which states have no tax Marca, The law consolidated the state’s seven tax brackets for individual income into two and reduced the top marginal rate from 6.75 percent to 6.5 percent. Use our income tax calculator to estimate how much tax you might pay on your taxable income.

Source: www.entrepreneur.com

Source: www.entrepreneur.com

States With the Lowest Corporate Tax Rates (Infographic), This page has the latest montana brackets and tax rates, plus a montana income tax calculator. The montana state tax calculator (mts tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

The 2024 Tax Rates And Thresholds For Both The Montana State Tax Tables And Federal Tax Tables Are Comprehensively Integrated Into The Montana Tax Calculator For 2024.

A comprehensive suite of free income tax calculators for montana, each tailored to a specific tax year.

Calculate Your Annual Salary After Tax Using The Online Montana Tax Calculator, Updated With The 2024 Income Tax Rates In Montana.

Customize using your filing status, deductions, exemptions and more.