What Are The Irmaa Income Brackets For 2025. As if it’s not difficult sufficient whereas not transferring the needle a lot, irmaa is split into 5 revenue brackets. Discover the 2025 medicare irmaa brackets, including updated income limits and how they affect your medicare premiums and benefits.

If you are trying to determine. In some cases, if the irs cannot provide your 2023 tax information,.

What Are The Irmaa Income Brackets For 2025 Images References :

Source: jameshughes.pages.dev

Source: jameshughes.pages.dev

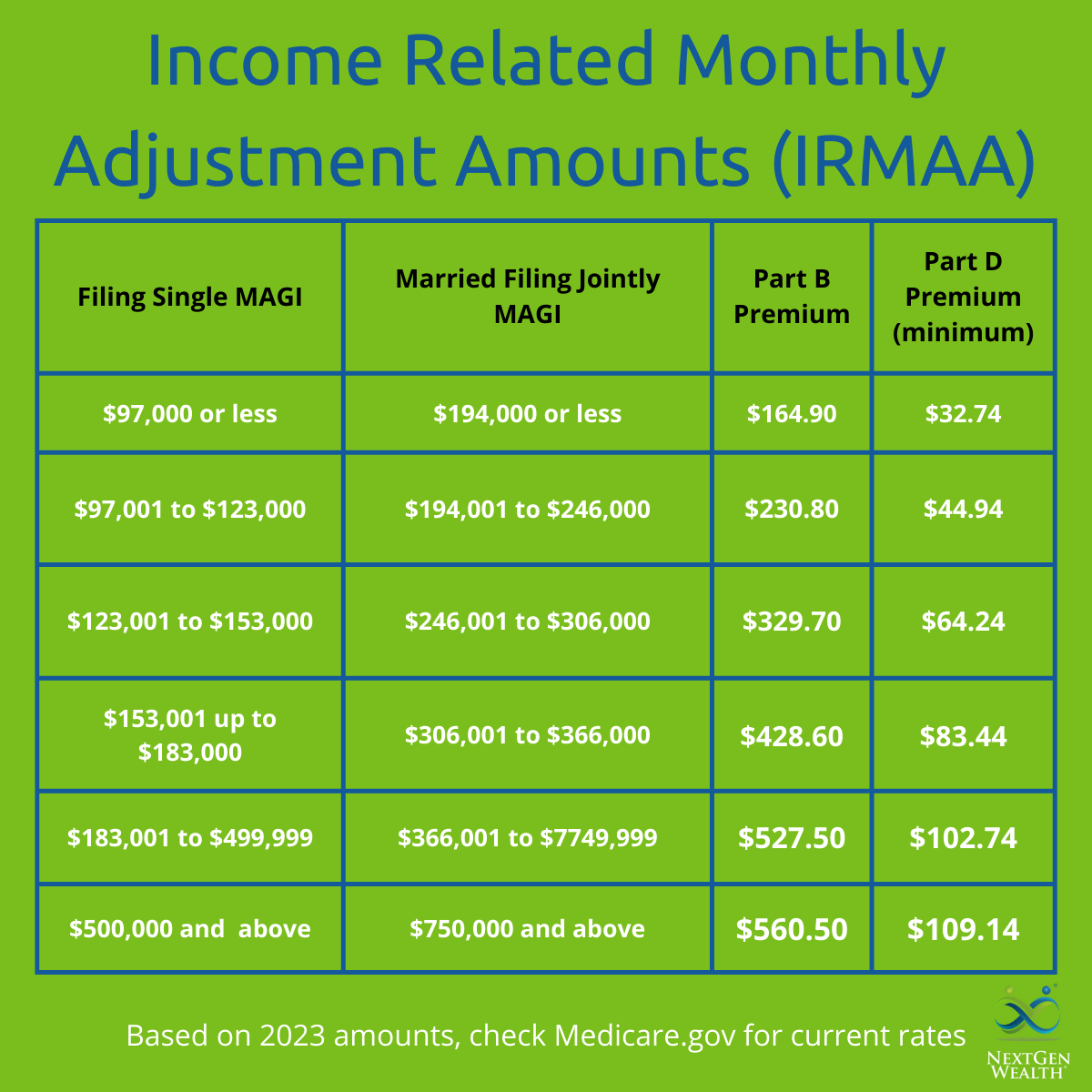

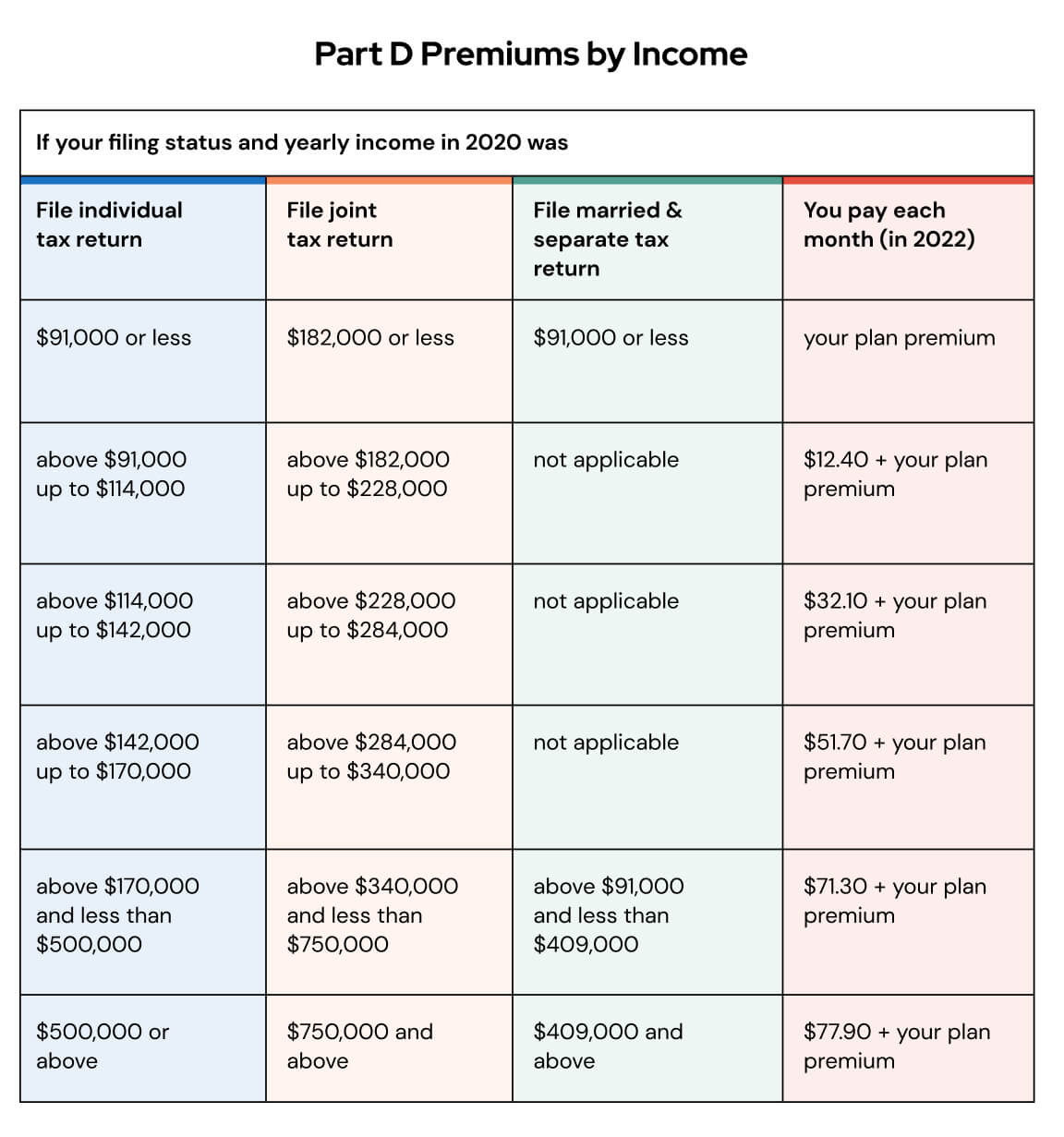

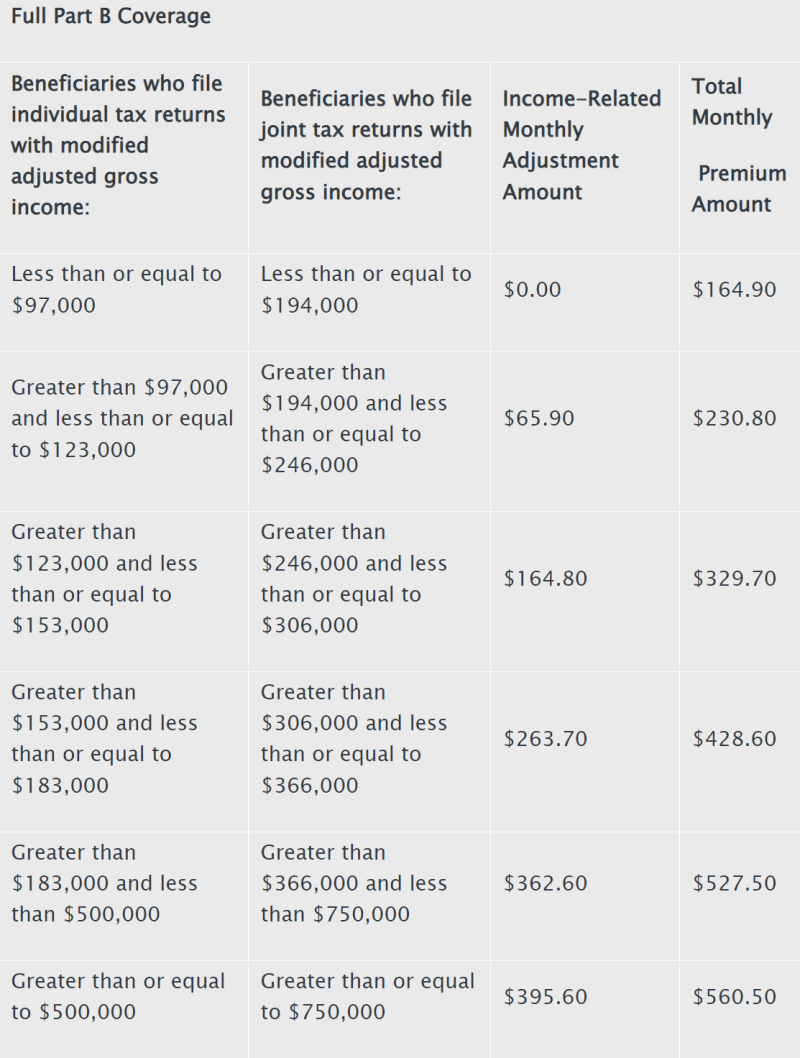

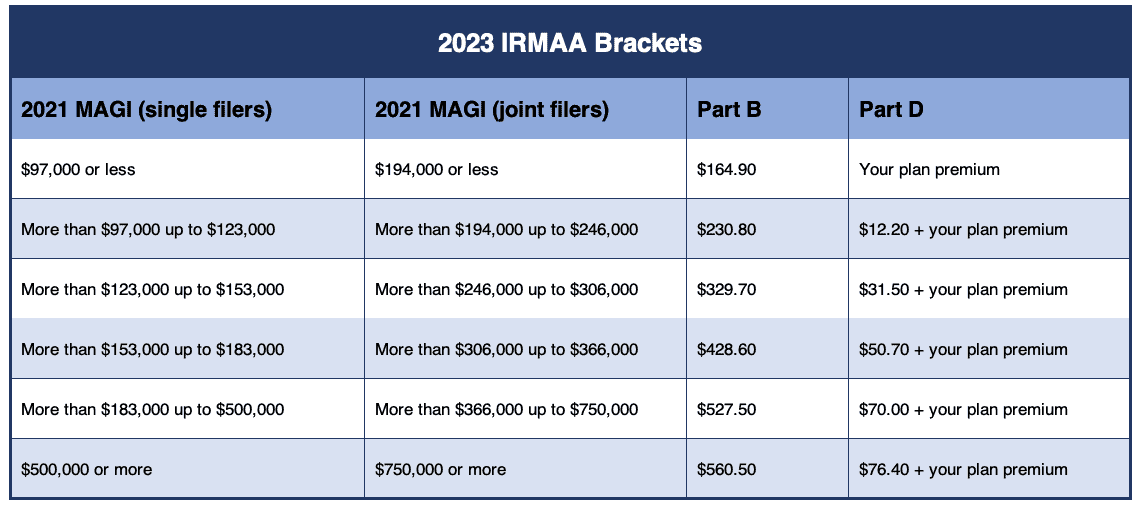

Medicare Premiums 2025 Irmaa James Hughes, For 2025, the irmaa brackets are determined by the income reported on 2022 tax returns, with thresholds starting at $103,000 for individual filers and $206,000 for married couples filing jointly.

Source: risahjkzitella.pages.dev

Source: risahjkzitella.pages.dev

2025 Medicare Part B Irmaa Premium Brackets By State Zorah Catarina, This article reviews the 2024 and projected 2025 irmaa income brackets, as well as how irmaa brackets are calculated and how you pay the extra surcharge.

Source: beckahjkannabella.pages.dev

Source: beckahjkannabella.pages.dev

Irmaa Brackets 2025 Charter Roxy Wendye, It essentially adds an additional amount to the standard.

Source: jennivlucretia.pages.dev

Source: jennivlucretia.pages.dev

Medicare Irmaa 2025 Brackets And Premiums Chart Tim Layney, The 2025 irmaa income brackets and parts b and d surcharges have been announced.

Source: lillianturner.pages.dev

Source: lillianturner.pages.dev

Irmaa 2025 2025 2025 Neet Lillian Turner, As if it’s not difficult sufficient whereas not transferring the needle a lot, irmaa is split into 5 revenue brackets.

Source: angilhjktuesday.pages.dev

Source: angilhjktuesday.pages.dev

Irmaa Brackets 20254 2025 Limits Jonis Mahalia, Remember that the irmaa calculation uses your modified adjusted gross income (magi) filed two years prior.

Source: blancahjklaverne.pages.dev

Source: blancahjklaverne.pages.dev

2025 Irmaa Brackets Married Jointly Limits Legra Adriena, For example, your 2025 irmaa will generally be calculated using income data from your 2023 tax return.

Source: norrivgratiana.pages.dev

Source: norrivgratiana.pages.dev

Irmaa Brackets 2025 And 2026 Limits Janaye Sarita, This article reviews the 2024 and projected 2025 irmaa income brackets, as well as how irmaa brackets are calculated and how you pay the extra surcharge.

Source: angilhjktuesday.pages.dev

Source: angilhjktuesday.pages.dev

Irmaa Brackets 20254 2025 Limits Jonis Mahalia, It increases costs and lowers social security benefits, find out what irmaa 2025 can be.

Source: marylasedorothea.pages.dev

Source: marylasedorothea.pages.dev

2025 Irmaa Brackets Based On 2025 Tax Rate Dinah Brittan, If you are a single filer with an income between $106,000 and $133,000, the surcharge for part b will.

Posted in 2025